Revolutionize Your Credit Management with our Credit Management System

Effortless Credit Control and Improved Financial Health

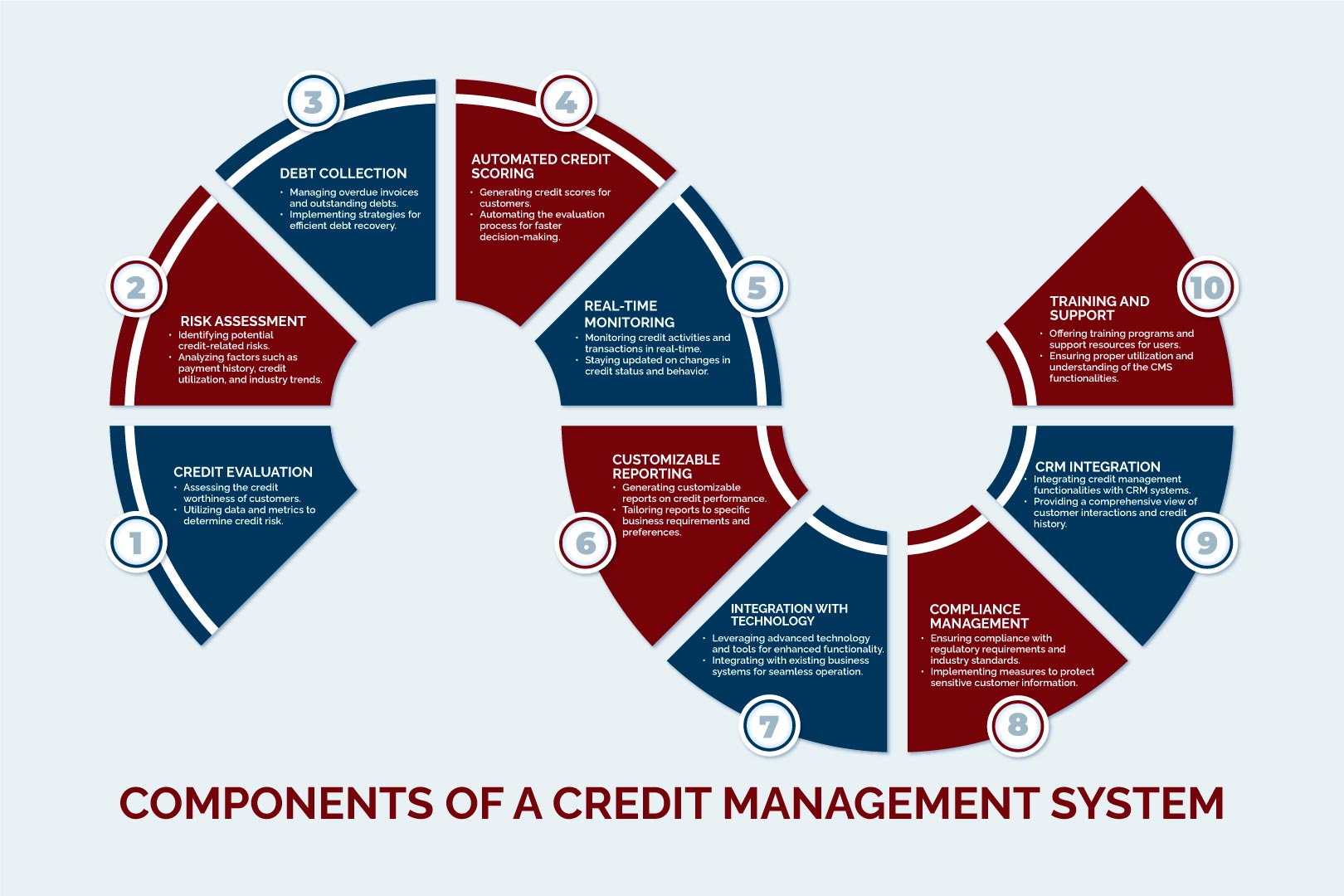

Revolutionize Your Credit Management with our Credit Management System" promises a transformative approach to handling credit within a business context. This system is designed to make credit control more efficient and effective. It typically leverages advanced technology and tools to streamline processes such as credit evaluation, risk assessment, and debt collection. The goal is to empower businesses to make informed decisions about extending credit to customers and to enhance their overall financial health. With features like automated credit scoring, real-time monitoring, and customizable reporting, this system can help companies minimize bad debt, reduce credit-related risks, and ultimately optimize their cash flow.

Cash Flow Optimization

It ensures a steady cash flow by minimizing late payments and bad debts, allowing a business to meet its financial obligations and invest in growth.

Risk Mitigation

Effective credit management helps identify and mitigate credit risks, reducing the likelihood of lending to customers who may default on payments.

Customer Relationships

It fosters healthy customer relationships by setting clear credit terms, which can lead to increased trust and loyalty.

Profit Maximization

Proper credit management enables businesses to extend credit to creditworthy customers, potentially increasing sales and profits.

Let's Get Started

Our Credit Management System offers a comprehensive solution to these challenges

Streamlined Operations

Our system automates credit assessment, approval, and monitoring processes, reducing manual work and errors. This streamlines credit operations and saves time and resources.

Data-Driven Decisions

By analyzing customer data and credit history, our system helps businesses make informed decisions about extending credit. It identifies high-risk customers and suggests appropriate credit limits.

Payment Tracking

Our system enables real-time monitoring of customer payments, sending alerts for overdue accounts, and facilitating efficient follow-up procedures.

Customizable Settings

It allows businesses to set their credit policies and parameters, ensuring that credit decisions align with their specific needs and risk tolerance.

Credit Reporting

Our system provides credit reporting capabilities, helping businesses assess the creditworthiness of customers and suppliers.

Key Features

Powerful Features for Effective Credit Management

Powerful Features for Effective Credit Management" encompasses a set of robust functionalities designed to bolster a company's ability to manage credit efficiently. These features typically include tools for assessing the creditworthiness of customers, creating customizable credit policies, automating credit approval processes, and monitoring credit limits in real-time. Additionally, they might offer advanced reporting and analytics capabilities to provide valuable insights into a company's credit portfolio.

Credit Application Processing

Simplify and expedite credit application processing. Streamline the submission, review, and approval of credit requests, reducing administrative burdens and enhancing efficiency.

Customer Credit Scoring

Assess the creditworthiness of customers accurately. Utilize advanced algorithms and historical data to assign credit scores, enabling data-driven decisions when extending credit.

Automated Payment Reminders

Minimize late payments and enhance cash flow by automating the delivery of payment reminders to customers. Customizable schedules ensure timely notifications.

Invoice Tracking and Management

Keep a close eye on invoices with our intuitive tracking and management tools. Easily monitor payment statuses, send invoices electronically, and reduce the risk of missed payments.

Credit Risk Assessment

Mitigate credit risks effectively. Our system conducts in-depth credit risk assessments, identifying potential high-risk customers and suggesting appropriate credit limits to protect against financial losses.

Real-time Credit Reporting

Access real-time credit reports on customers and suppliers. Stay informed about changing credit positions, enabling quick adjustments to credit terms and strategies.

Compliance Management

Ensure adherence to credit regulations and internal policies effortlessly. Our compliance management feature helps businesses stay in compliance, reducing legal and financial risks

How It Works

Simplified Credit Management Process

The "Simplified Credit Management Process" involves streamlining the intricacies of credit management into an accessible and efficient workflow. Typically, this process leverages software and technology solutions that automate and simplify key credit management tasks. It often begins with customer credit evaluation, using predefined criteria or automated algorithms to determine creditworthiness. Once credit limits are set, the system monitors them in real-time, issuing alerts or blocking transactions when limits are exceeded. It may also incorporate credit policy customization and documentation, allowing businesses to tailor their credit strategies to specific needs.

Credit Application Submission

Customers submit credit applications electronically through the system.

Credit Scoring and Approval

The system assesses the creditworthiness of applicants based on predefined criteria. Automated scoring helps in making informed approval decisions quickly.

Payment Reminders and Notifications

Automated payment reminders are sent to customers as per customizable schedules. Notifications alert businesses about upcoming and overdue payments.

Invoice Tracking and Alerts

Invoices are tracked within the system, ensuring timely invoicing and reducing payment delays. Alerts are generated for any unpaid or overdue invoices.

Credit Risk Assessment and Monitoring

Continuous credit risk assessment identifies high-risk customers. Credit limits are suggested to minimize potential losses.

Real-time Credit Reporting and Insights

Access up-to-the-minute credit reports on customers and suppliers. Gain insights into evolving credit positions to make agile credit decisions.

Compliance Checks and Reporting

The system conducts compliance checks to ensure adherence to regulations and internal policies. Detailed compliance reports are generated for audit and risk management purposes.

Benefits

Unlock the Benefits of Our Credit Management System

Unlock the Benefits of Our Credit Management System. Experience the advantages of our Credit Management System through these key benefits.

Improved Cash Flow Management

Optimize your cash flow by minimizing late payments and ensuring timely collections, enhancing financial stability.

Reduced Bad Debts and Late Payments

Identify high-risk customers and reduce bad debt occurrences, leading to healthier bottom lines and reduced financial stress.

Enhanced Customer Relationships

Transparent credit processes and effective communication improve trust, fostering stronger and lasting customer relationships.

Real-time Insights for Informed Decisions

Access up-to-the-minute credit information to make data-driven decisions swiftly and respond to evolving credit situations effectively.

Streamlined Compliance and Reporting

Ensure compliance with regulations and internal policies effortlessly while generating detailed reports for audit and risk management purposes.

Increased Operational Efficiency

Automate credit-related tasks, reducing manual efforts, and saving time and resources for more strategic initiatives.

Integration Capabilities

Seamless Integration with Your Existing Systems

Our integration capabilities offer several key advantages. Firstly, they involve data synchronization, which means that information is consistently updated in real-time across all connected platforms. This ensures that your team always has access to the most current customer data, improving the accuracy of credit decisions and reducing the risk of errors. Additionally, our system supports integration through open APIs, which are essentially bridges that allow different software applications to communicate with each other. This flexibility ensures that our credit management system can easily fit into your existing technology environment, adapting to your unique needs and workflows. Ultimately, this seamless integration not only simplifies credit management but also elevates your overall business efficiency, facilitating better-informed decision-making and helping you stay competitive in your industry.

Accounting Software

Link our system with popular accounting software like QuickBooks, Xero, or SAP to synchronize financial data and streamline credit processes.

CRM Systems

Integrate seamlessly with CRM systems like Salesforce or HubSpot to ensure that credit information is readily available when interacting with customers.

ERPs

Connect with Enterprise Resource Planning (ERP) systems like Oracle or Microsoft Dynamics for comprehensive financial data management.

Payment Gateways

Sync with payment gateways to facilitate real-time payment processing and reconciliation.

Reporting Tools

Export credit-related data to reporting tools like Tableau or Power BI for in-depth analysis and visualization.

Email Platforms

Link with email platforms such as Outlook or Gmail to automate communication related to credit management, including payment reminders and notifications.

Support and Training

Dedicated Support and Training

At Techno Solutions we are committed to ensuring your success with our Credit Management System. We provide a comprehensive support and training program to assist you every step of the way:

Onboarding Assistance

Our dedicated team will guide you through the setup and configuration process, ensuring a smooth transition to our system.

Training Resources

Access a wealth of training materials, including video tutorials, user guides, and documentation, designed to empower your team with the knowledge to maximize the system's potential.

24/7 Customer Support

Our customer support team is available around the clock to address any questions, concerns, or technical issues you may encounter. We are just a call or message away.

Regular Updates

Stay current with our system's enhancements and new features through regular updates. We ensure that you are always equipped with the latest tools for effective credit management.

Customized Training

Tailor-made training sessions can be arranged to meet the specific needs of your organization, ensuring that your team is proficient in using the system efficiently.

Dedicated Account Manager

Enterprise-level customers benefit from a dedicated account manager who will provide personalized assistance and guidance.